Predicting the Impact of Benefit Design Changes on Enrollment to Drive 2019 Product Strategies

Product strategy planning for 2019 is well-underway for Medicare Advantage Organizations (MAOs) with bid submission deadlines just around the corner. Considering the number of possibilities for product attribute changes and the potential repercussions, it is important for MAOs to proactively understand the impact of changes to premiums, copays, and other pricing strategies on enrollment.

Machine Learning Model to Predict Enrollment

To help MAOs do this, Pareto’s data science team investigated trends in product elasticity over the past three years to better understand patterns that correlate to changes in enrollment. We built a machine learning model to predict monthly enrollment based on plan attributes and explored elasticity trends. We did not evaluate network design and formulary benefits in this initial exercise, but we will explore using them in future analyses to assess their impact on enrollment.

Our model was designed to eliminate the noise of non-product-based factors on enrollment, like market entrants and exits, to focus specifically on how individual product pricing and benefit designs drive buying decisions. Here are three main takeaways from our analysis:

- At the end of the day, it’s all about premium. Unsurprisingly, out of all the factors we assessed, product premiums impacted enrollment the most. Understanding that consumer selection is most elastic based on premium, plans must anticipate the magnitude of the impact from increasing premiums on enrollment, especially in zero premium markets.

- Part C premium changes are more elastic than Part D. Consumer selection does appear to be more sensitive to Part C premium changes than Part D premium changes. The Low-Income Premium Subsidy, which in 2016 was available to more than 20% of MA-PD enrollees, may factor into this outcome. The Low-Income Premium Subsidy covers an enrollee’s Part D premium up to the benchmark premium, meaning that some of the potential enrollment loss may be mitigated because not all enrollees are subject to the full Part D premium increase.

- Specific benefit design changes matter less. Outside of premiums, deductibles, and maximum-out-of-pockets (MOOPs), the more specific benefits had an immaterial impact on overall enrollment. The one minor exception to this is the primary care physician benefit, which showed some elasticity on consumer enrollment as changes were made to copay/coinsurance levels. This is likely because of broader utilization from the consumer population relative to other benefits.

Exploring Elastic and Inelastic Product Design Elements

Our Product Elasticity Model considers all plan attributes as well as historical enrollment and inherent market variables to evaluate how changes to certain benefits will impact enrollment. The market variables for the county include number of plans, size of Medicare eligible population, and average premiums. We also aggregated enrollment by organization as a proxy for brand awareness and popularity, which can play a crucial role in consumer purchases. These variables help provide a baseline to better understand trends in elastic attributes.

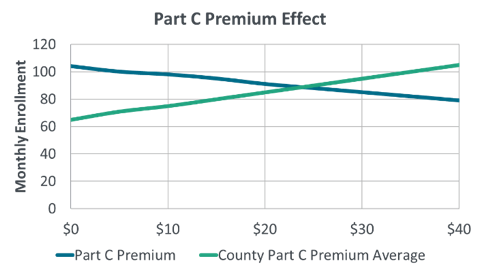

Part C and Part D premiums are the two most elastic variables. As indicated by Figure 1 below, increases to Part C premiums generally have a negative impact on enrollment. However, the Part C premium average of the county is even more elastic than the Part C premium of the plan itself. In this case, if Part C premiums in the county were to increase on average, and the plan’s premium stayed the same or had a smaller increase than the average, enrollment would be positively impacted. The same effect is not seen for Part D premiums.

Figure 1

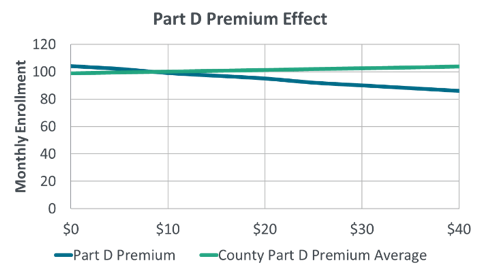

The Part D premium county average is relatively inelastic as indicated by the green line in Figure 2. Part D premium amount is also relatively inelastic, meaning price changes do not significantly impact enrollment. Individual MA products offering Part D are more likely to attract consumers; however, consumers may be enrolling in a Part C product and shopping around for a separate individual Prescription Drug Plan with more attractive premiums.

Figure 2

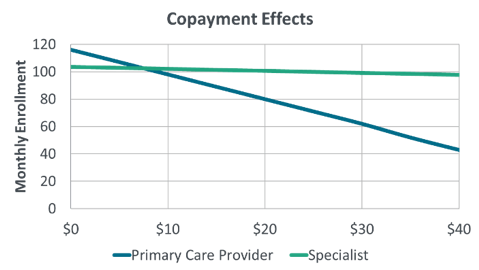

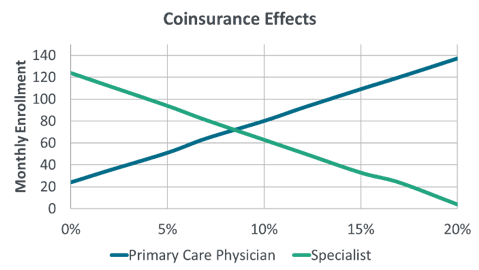

The number of copayments and coinsurances and their effect on enrollment is more intricate than premiums. Figure 3 shows two copayments, primary care provider (PCP) and specialist, which are elastic and inelastic, respectively. An increase in PCP copayments shows a large drop in enrollment, even more so than an equivalent increase in premiums, whereas increases in specialist copays do not significantly impact enrollment.

Figure 3

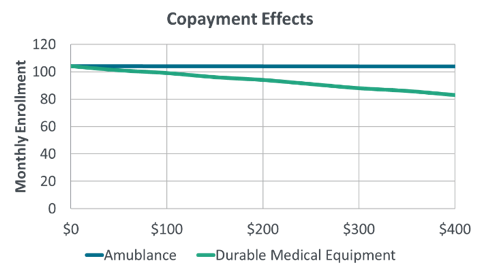

Figure 4 shows ambulance and durable medical equipment (DME) copayments. While ambulance copayments can be up to $400, the variable itself is not very elastic and therefore does not have a strong impact on consumer product selection decisions.

Figure 4

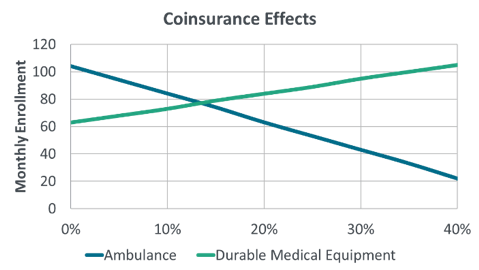

Because the coinsurance percentage does not reflect the cost of the visit itself, a consumer may be willing to accept higher coinsurance for a cheaper or less frequent medical need, especially in exchange for more attractive premiums. As shown in Figure 5, plan enrollment increases as PCP coinsurance increases (blue line). Our hypothesis is that these increases in coinsurance are associated with lower premiums, and because PCP visits are less expensive than specialist visits or ambulance bills, consumer choice is not negatively impacted. We found a similar pattern for DME coinsurance (Figure 6, green line). Additionally, while the copayments for a specialist visit and ambulance are relatively inelastic, increases in coinsurance for these benefits show a larger decrease in enrollment. This is most likely due to consumers shouldering a higher percentage of these more expensive services.

Figure 5

Figure 6

Using Our Model to Predict 2018 Enrollment

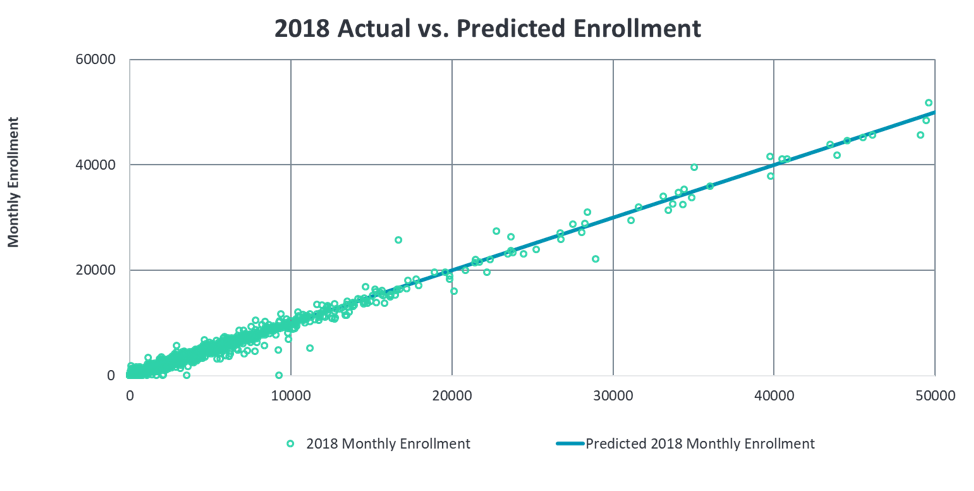

We also used our product elasticity machine learning model to predict 2018 enrollment and compared it to the average 2018 monthly enrollment through April.

The graph above depicts our capability to capture general enrollment trends. Our model is able to predict enrollment with a low margin of error capturing 99% of the variance in monthly enrollment on average.

At the plan level, Table 1 shows specific examples of how the model responded to premium changes in 2018. For these select comparisons, the monthly enrollment for each product was accumulated by state instead of county. Table 1 lists the actual and our predicted 2018 monthly enrollment average for four example products in different states and of varying size. We also listed the difference between the two values for a quick comparison. The predictions exhibit that our model performs reasonably well when significant product attributes change in addition to capturing general patterns.

Table 1

| Product | Part C Premium Change | Part D Premium Change | Actual Enrollment | Predicted Enrollment | % Accuracy |

| 1 | $0 | -$2 | 46,808 | 45,451 | 97.1% |

| 2 | -$1 | $1 | 30,710 | 29,572 | 96.3% |

| 3 | $10 | $0 | 4,590 | 4,714 | 97.3% |

| 4 | $10 | $0 | 5,689 | 6,187 | 91.2% |

| 5 | $0 | $7 | 2,423 | 2,398 | 99.1% |

What Comes Next?

This version of the Product Elasticity Model is one example of our ability to harness advanced data science specifically for MA product strategies. Our focus is to aid MAOs in making data-driven product design decisions, specifically for changes to existing plan attributes.

Future enhancements could include additional models to provide a more extensive product strategy guide. This might include tracking market competitor movement and detailed Part D analysis investigating the importance of specific prescription offerings.

Still, as it stands now, the Product Elasticity Model is an extremely helpful tool for plans to utilize during product strategy planning. For any product, the tool helps guide plan attribute design decisions and understand the effects of these changes on enrollment.

Appendix: Methodology

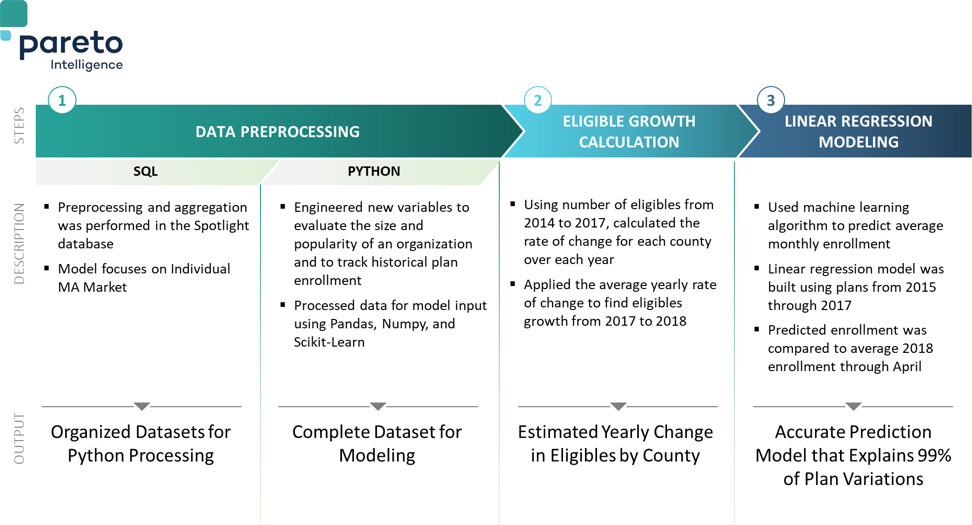

For the tech-minded, we’ve provided a behind-the-scenes peak at our data science process in the diagram below. Still want to know more? Contact us for answers to your questions!