Medicare Advantage Star Ratings: Were you surprised by the Star results?

Admittedly, we were not. For years, the Centers for Medicare & Medicaid Services (CMS) has intimated that changes to the Medicare Advantage Star Rating framework would make it more challenging to achieve and sustain 4+ Star performance. Some have pointed to a correction of the inflated Star Ratings observed during COVID; however, CMS has continuously modified the Star framework, making it increasingly difficult to predict cut points, forecast performance, and achieve 4+ Stars. The impending shift from the Reward Factor to the Health Equity Index (HEI) is another change that will continue this trend, making it more challenging for plans to achieve and sustain 4+ Stars beginning in SY2027.

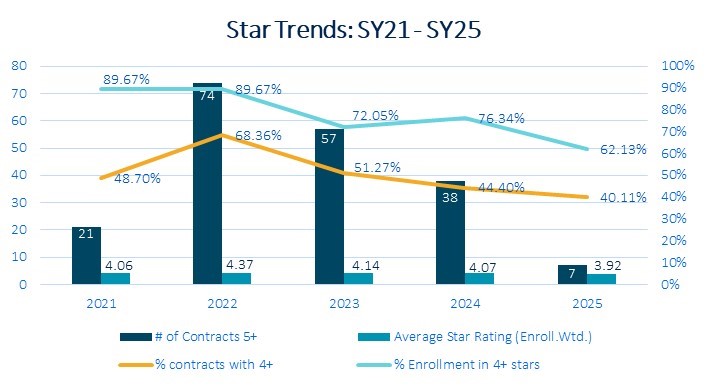

A snapshot of the latest Star Ratings illustrates how the landscape is changing. The number of 5-Star plans, the percentage of members in 4+ Plans, and the enrollment-weighted Average Star Rating are all at the lowest they have been in the last five years.

Source: CMS Quality Performance data

Again, are we surprised? No.

Why is Navigating Star Ratings More Difficult Now, and Will It Get Easier?

Multiple factors impact Star Rating performance and a health plan’s ability to achieve and sustain a 4+ Star Rating. It begins with the simple fact that CMS is intentionally making it more difficult. In 2023, CMS paid out nearly $13 billion in Quality Bonus Payments when 72% of members were in 4+ Star plans. By reducing the number of members in 4+ Star plans, CMS expects to realize a savings of $2.3 billion by 2028.

Additionally, Star Ratings are getting more challenging due to:

- Increasing and tighter CMS cut points. The majority of cut points increased this year beyond historical norms, despite plan improvements in raw performance. For example: Controlling Blood Pressure (CBP) measure is weighted 3x, and as an industry, we’ve seen an improvement in raw performance from 73% to 76% between SY24 and SY25 (the average of plans reporting). Yet, the average Rating for CBP decreased from 3.4 to 3.0 Stars.

At the same time, cut points continue to tighten, leaving very little, if any, margin for error. For many CAHPS measures, the difference between 5-Star performers and 2-Star performers is only 4 percentage points.

- Star measures are harder to ‘chase’. The Star measures themselves require a more complex, system-based approach to solving and cannot simply be achieved by 'chasing the measure'. For instance, what needs to be true for managing blood pressure among your membership throughout the year is very different from what is necessary for patients to receive their diabetic retinal eye exam once a year.

- Replacing the Reward Factor with Health Equity Index. Although this did not impact the 2025 Star results, it will undoubtedly accelerate the trends we observed in the 2025 Star Year and should be on everyone’s radar. HEI (worth 0.4 Stars) is a two-step calculation: first, plans must qualify for it, by having the right member mix; second, plans must perform well in certain Star measures among their population with social risk factors.

In speaking with dozens of health plans, almost none have changed their product, marketing, and sales strategies to adjust their H-Code member mix for the HEI qualification. For some, this was intentional. For most, HEI is not on anyone’s radar outside of their Quality Team. We expect this to have a negative impact on Star performance in 2027 for those not proactively strategizing and planning for significant changes.

What Do Medicare Advantage Plans Need to Do?

"You do not rise to the level of your goals. You fall to the level of your systems." – James Clear

Ongoing, sustained Star performance requires a system-wide strategy and execution plan and cannot be achieved from point solutions that occur in different parts of the health plan or solely by the Quality or Star Team. Key areas of consideration should include:

- Data-driven strategies. Multi-year, data-driven strategic planning that empowers plans to scenario plan (what’s the best path to the next ½ Star?), determine what’s needed to optimize HEI, and better understand the problems to solve. A robust strategy informs the necessary work, its value, and defines the mobilization and cross-functional execution plan needed to activate a members’ care journey and drive change.

- Maturing value-based care and service models. More mature and coordinated value-based care and service arrangements that incentivize and enable heightened care journey management, as well as personalized clinical and social services.

- Activating members to take their next best step in their care journey. Getting members to engage requires understanding where they are, identifying their next best step to support their care journey, and orchestrating and optimizing member touchpoints –not spamming them with all the actions needed from different health plan business units.

Pareto Intelligence works with our clients to define the levers of influence necessary to impact systematic change and drive Star improvements. Whether that is product strategy and benefit operations, optimizing touchpoints and activating members, working across all functions to align interests and action, or projecting and scenario planning to get to the next ½ Star, we are here to help. To learn more about how we can support your journey toward Improved Star performance, please contact us at contact@paretointel.com.