Power of the Pen: Potential Implications of Trump’s Executive Order on the ACA

On October 12, 2017, President Trump signed an executive order initiating significant changes to key provisions of the Affordable Care Act (“ACA”). The Executive Order on its own has no force of law so the coming weeks and months should provide more clarity as the respective federal departments draft new regulations. The key parameters of the Executive Order are:

- The immediate stoppage of Cost Share Reduction (“CSR”) payments to issuers and legislative uncertainty. Many state insurance departments required issuers to assume CSRs would not be funded when submitting their 2018 rates, and those that did not are now permitted to file new rate increases by the Center for Medicare and Medicaid Services (“CMS”). There is still uncertainty as to whether issuers will receive payments for the remainder of 2017, and already 18 states have sued the Trump Administration in response. Further contributing to the uncertainty around 2017 payments and the stoppage of future CSR payments, Senators Alexander (R-TN) and Murray (D-WA) announced a preliminary deal on October 17 to fund CSR payments through the next two years as a short-term solution to reduce market volatility and permit further discussion on a long-term solution. As of publication of this alert, it is unclear as to whether the funding will be passed by the Senate or even considered by the House.

- Consumers can purchase insurance across state lines. A cornerstone provision Republicans have been pushing for in an effort to increase market competition and lower premiums.

- The creation of association health plans (“AHPs”). Loosens regulations to allow small businesses to band together to diversify their risk and strengthen their purchasing power.

- Expansion of short-term, limited duration insurance (“STLDI”) policies. Expands the coverage period of short-term policies, which were limited to less than three months, and exempts such policies from ACA’s coverage mandates.

- Expansion of health reimbursement arrangements (“HRAs”). Tax-advantaged benefits an employer can provide its employees to then go purchase insurance, with the objective of expanding employee choice.

Below are some preliminary considerations for issuers by ACA market, though there is still great uncertainty as to where things will wind up. It will be critical to understand the specifics of each regulation once defined so issuers can decide whether they’ll continue to participate in the market, and if so, how they’ll adjust their strategy to mitigate risks and achieve positive financial performance.

Considerations for the Individual Market

Changes to membership. The introduction of short-term policies presents an alternative product option to unsubsidized and healthier consumers, leaving higher risk members in the ACA risk pool. Many issuers have increased premiums in 2018, however, it is unclear whether this adjustment will be adequate if short-term policies significantly disrupt the market. The ACA pool will also continue to shift to being more heavily concentrated on individuals receiving subsidies as these members will be shielded from the premium increases.

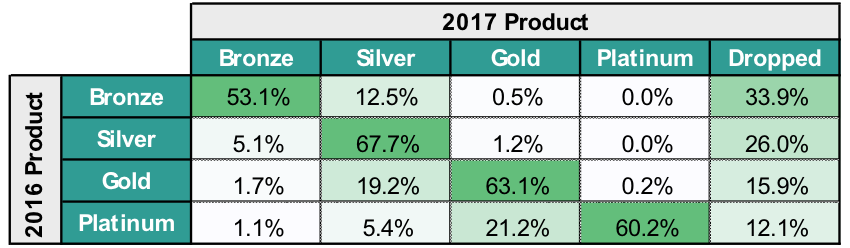

Shift in buying habits. Over the past three years of the ACA, we’ve seen a downward shift in consumer purchasing patterns with consumers buying lower actuarial value (“AV”) products as premiums continue to increase. In addition, there has been significantly more churn among lower Bronze and Silver purchasers, as highlighted in the exhibit below, in which 33.9% of 2016 Bronze purchasers did not renew with the same issuer in 2017.

Individual Consumer Purchasing Patterns from 2016 to 2017*

*Based on an analysis across the Pareto Community.

The trend of buying down or members opting out of the ACA Individual Market will likely continue for those unsubsidized consumers who are feeling the full brunt of premium increases. As it pertains to Silver members, some states advised issuers to only adjust Silver premiums to account for the defunding of CSRs, making Silver premiums close or equal to Gold. This may result in some members buying up to Gold.

The ability to procure insurance across state lines may impact some regional markets but faces geographic and network challenges. Such purchases would require either the consumer to travel into the purchasing state for services or for the issuer to have adequate network coverage in that consumer’s state and local market. The former significantly limits the applicability of such purchases to a subset of the population, and the latter requires issuers to develop expanded networks which will take considerable time to do well.

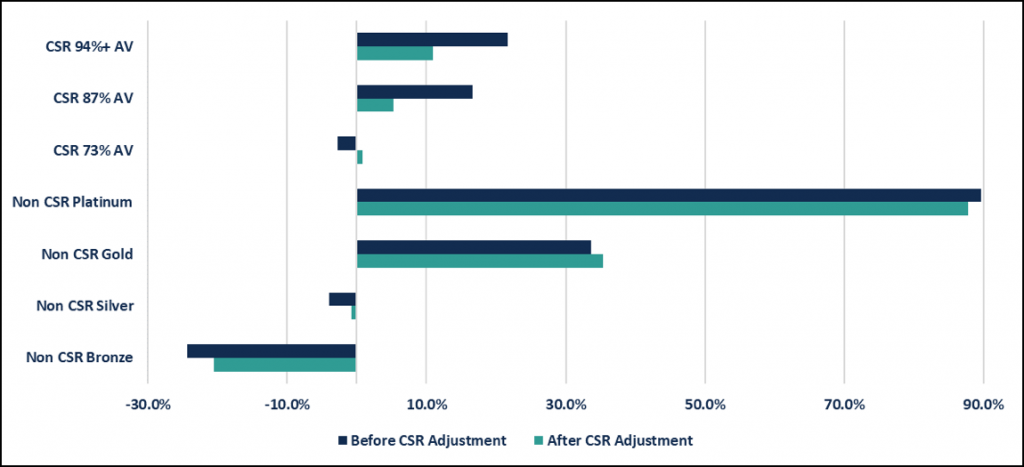

Change in market economics. The elimination of CSR payments significantly changes the economics of the Individual Market, as CSR-eligible members were generally one of the best financially performing subpopulations due to the incremental adjustments made to their risk scores. Earlier this year, the U.S. Department of Health & Human Services (“HHS”) released draft guidance on how they’d modify the risk adjustment model if CSR was eliminated, which was essentially to eliminate the current CSR methodology and score each member based on the equivalent AV metal level. For 73% AV Silver CSR plans, CMS would apply Silver plan coefficients. For 87% and 94% Silver CSR plans, CMS would increase coefficients to the equivalent of 90% AV Platinum plans. The CSR adjustment factor would be dropped from the model, and the respective plan coefficients and induced demand factor (IDF) would be applied instead. Considering this new guidance, Pareto analyzed the change in transfer payments as a percent of premium on a per member per month (“PMPM”) basis across the Pareto community. As illustrated by the graph below, the transfer payments for Platinum-level AV members (i.e., CSR 94%, CSR 87% & Platinum) decrease. Inversely, lower AV members (i.e. CSR 73%, Silver Non-CSR and Bronze) are positively impacted by this adjustment, decreasing their transfer outflows.

Transfer Payments as a Percentage of Premium by Metal & CSR Tier

(comparing before and after the introduction of the new CSR guidance)

Considerations for the Small Group Market

Changes to member makeup. The creation of AHPs could have a material impact on the Small Group Market if the regulations provide enough flexibility and incentives for employers to pursue. The risk imposed to the Small Group Market is the exodus of healthy groups who band together with others to obtain lower premiums, leaving only high-risk groups in the Small Group ACA Market. This would have a similar impact as the Individual Market where issuers would be forced to raise premiums to account for the higher risk of the remaining participants.

Shifting from defined-benefit to defined-contribution. HRAs are not a new concept and the shift in product-buying decision created by providing employees with a defined-contribution to buy their own coverage is the foundation of the private exchange employer market. If enacted and adopted, the key consideration is what product(s) do these consumers purchase? They may enter the ACA Individual Market or purchase short-term policies, impacting the makeup of each markets' respective population.

Looking Ahead to 2019 Participation & Product Decisions

Additional regulatory guidance, 2018 competitor participation decisions, and the buying decisions of members during open enrollment should provide key insights into each issuers’ regional market(s). Therefore, in addition to finalizing 2018 participation, issuers should begin looking ahead to 2019 and the development of their participation and product strategies.

- Competitor Movements: The potential for additional market exits may further shape regional markets and generate less competition in particular geographies. In addition to changes in ACA issuer participation, the potential rise of the short-term policy market and AHPs may change the overall risk makeup of the Individual & Small Group state risk pools. Understanding how specific subpopulations contribute to an issuer’s financial performance can provide meaningful insight into overall materiality to inform ongoing strategies.

- Member Acquisition, Retention, and Navigation: The expected changes to the risk adjustment model due to eliminating CSR, in addition to the annual changes to the coefficients, will impact the post-risk adjusted economics of the various market subpopulations. Forecasting the impact of these model changes can inform member retention strategies, as well as shape an issuer’s target populations for acquisition.

- Product Design: The buying decisions of consumers during the upcoming 2018 open enrollment should provide some insight into how the market will react. In addition to understanding how premiums and deductibles are impacting consumers’ buying decisions, issuers should evaluate how their product decisions influence certain utilization behaviors once they’re in the product, both positively and negatively.

- Issuer Operations: Improving issuer operations to ensure revenue accuracy and achieving targeted cost management outcomes will continue to be imperative for long-term success. On the revenue side, this includes both the closure of risk documentation gaps through evolved prospective and retrospective strategies, as well as achieving end-to-end data integrity that ensures all information generated at encounter is making it through internal systems and ultimately accepted by HHS. On the cost side, it requires a multi-faceted strategy that first identifies those impactable areas presenting the most opportunity and then executing proven strategies that generate better health outcomes.